Press Room

Guide – Which employees pay PAYE Tax in SA

Understanding your tax duties can be tricky, mainly with Pay As You Earn (PAYE) tax in South Africa. This detailed guide will help you understand employee tax duties. Let’s discover which employees pay PAYE tax.

4 min article

Tshwane universities unite in feasibility research for SA tax clinics project

Tshwane University of Technology (TUT), University of Pretoria (UP) and University of South Africa (Unisa) launched a collaborative research project early in May 2025, to determine the feasibility and sustainability of establishing South African tax clinics to provide free tax education and support to unrepresented taxpayers.

4 min article

SARS turns up the heat on tax dodgers

The taxman is getting a serious financial upgrade from the National Treasury and are investing an extra R4-Billion this financial year on top of the R7,5-Billion already budgeted for the next three years. This is aimed at sharpening the revenue service tools, tightening compliance and hunting down those who still owe the taxman.

2 min 50 second video

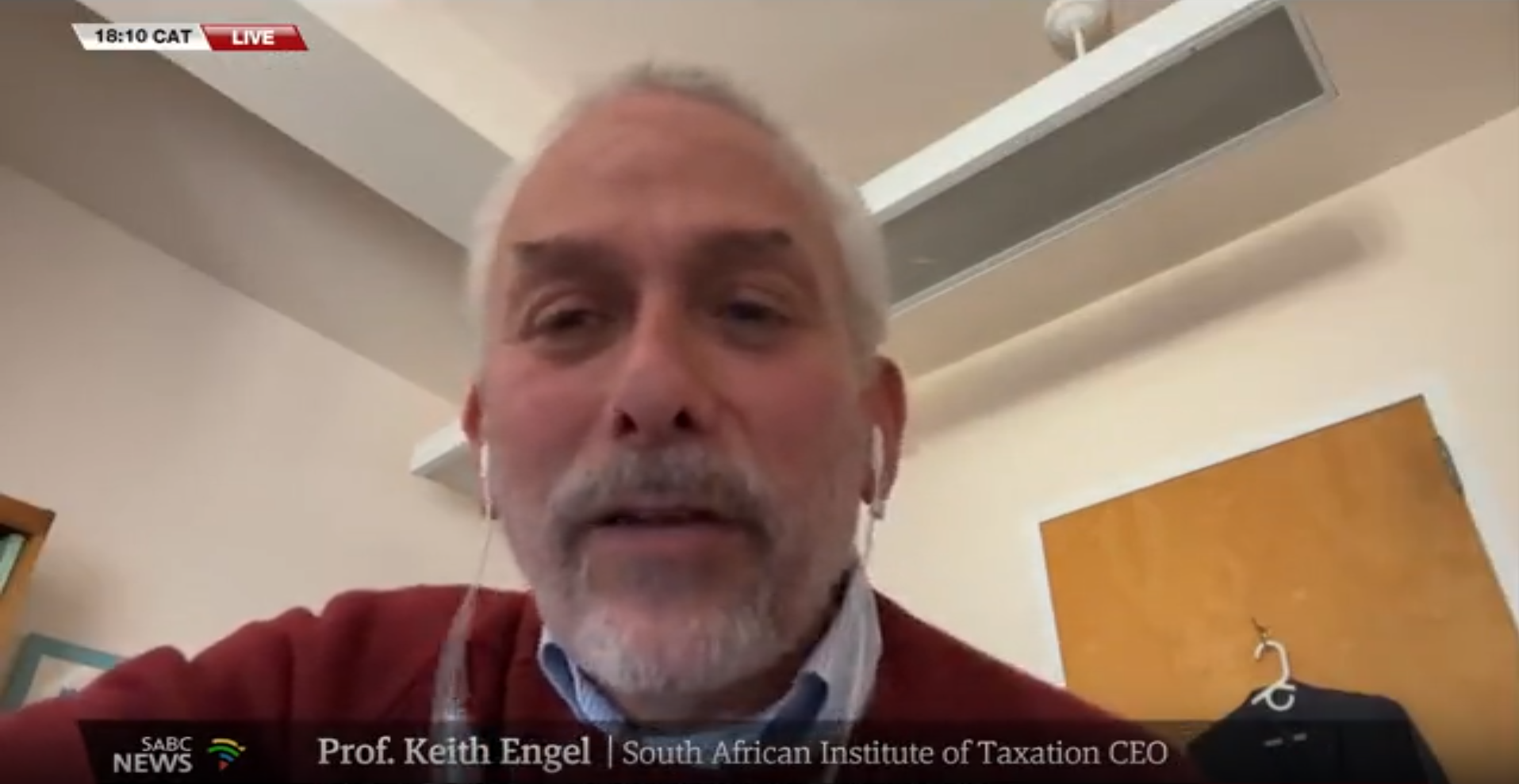

Reaction to the national budget 2025

With the last two attempts scuppered by a standoff over VAT hike that has since been scrapped; the estimated revenue shortfall sits at approximately R75BN. Keith Engel, Chief Executive Officer at the South African Institute of Taxation, shares his views.

5 min video

National Budget 3.0

SAIT’s Keitumetse Sesana weighs in on

the budget delivered by Finance Minister Enoch Godongwana.

8 min video

SARS Targets South Africans With Outstanding Tax Debt in Major Collection Drive

SARS Targets South Africans With Outstanding Tax Debt in Major Collection Drive

5 min read

SARS said to be planning ‘AmaBillions’ blitz to collect outstanding tax, plug fiscal hole

SARS said to be planning ‘AmaBillions’ blitz to collect outstanding tax, plug fiscal hole

5 min read

SARS offers more time for VAT hike reversals

Keitumetse Sesana said the VAT increase reversal was good news for businesses, as many were considering absorbing the increase to cushion consumers. But she warned that there needed to be certainty about the court case brought by the DA and EFF challenging the original VAT increase which was still continuing.

6 min read

Reversal of VAT increase. All good?

A discussion with SAIT’s Mabutho Mthembu about the recent withdrawal of the proposed VAT increase.

14 min video

ANC’s Mbalula calls for ‘constructive talks’ for future bills

Mbalula was speaking at a joint media briefing in Sandton, Johannesburg, attended by the 11 political parties who voted in favour of passing the budget with the understanding of possible reforms of the fiscal framework.

3 min read

VAT remains at 15%

In conversation with Professor Keith Engel the Chief Executive Officer for the South African Institute of Tax Professionals to give reaction to the VAT aversion by Finance Minister Enoch Godongwana.

No VAT increase. Is this good for business?

A discussion with the Strategic Lead for Stakeholder Engagement and Legislation at SAIT, Keitumetse Sesana, about the recent withdrawal of the proposed VAT increase. Int: Keitumetse Sesana.

7 min interview

Government’s late VAT hike reversal hits business

The government’s last-minute reversal of the VAT hike sparked criticism, as businesses had already spent millions.

3 min read

Withdrawing the VAT increase is good news for business but…

Last week it was still all systems go for the VAT rate to increase to 15.5% on 1 May 2025. This morning South African businesses and consumers woke up to the news that Finance Minister Enoch Godongwana has withdrawn the proposed increase of 0.5 percentage points.

Urgent court application to halt VAT increase

The High Court in Cape Town is hearing an urgent application to halt a VAT increase brought by the DA and the EFF. Both parties challenge the legality and constitutionality of the hike, announced as part of the revised fiscal framework.

6 minute video

No adjustments in personal income tax and inflation

The National Treasury has decided not to adjust personal income tax brackets and rebates for inflation in the 2025/26 financial year. This may result in a higher tax liability should you receive a salary increase. South African Institute of Taxation’s Keitumetse Sesana explains what this means.

11 minute video

How taxes are killing South Africa’s economy

In this episode of Money, Markets and Masterminds, Citywire South Africa and Keith Engel (pictured below), CEO of the South African Institute of Taxation, break down the true impact of government tax policies. We explore whether the country is pushing past the top of the Laffer Curve, how tax complexity is strangling businesses and the economy, and why endless hikes might do more harm than good.

5 minute read

What is VAT? Keitumetse Sesana breaks it down

What is VAT? SAIT’s Keitumetse Sesana breaks it down.

5 minute read

VAT increases by 0.5 percent point – reaction

A discussion with Keitumetse Sesana of the South African Institute of Taxation, about the 2025 Budget Speech.

9 minute video

Godongwana set to re-introduce budget delayed by VAT dispute

Finance Minister Enoch Godongwana is set to re-introduce budget delayed by VAT dispute. South African Institute of Taxation CEO, Keith Engel and KPMG Lead Economist, Frank Blackmore Watch video for more.

1 min video

What is bracket creep? Keitumetse Sesana tells us more

Bracket creep is a term to describe an increase in taxes that occurs when the marginal tax brackets are not adjusted annually for inflation.

5 minute read

Budget Speech to be delivered tomorrow

Newzroom Afrika presenter discusses the budget speech expectations with Keitumetse Sesana from the South African Institute of Taxation. Watch interview

8 min 26 sec video

Discussions around the contentions VAT increase

As Finance Minister Enoch Godongwana will table his budget speech tomorrow, various sectors including ordinary South Africans will be waiting with baited breath to see if there will be a VAT increase. While some are calling for an increase in the allocation for local government. Also having unions warning government not to renege on the 5.5 percent wage offer that was presented to unions in the public sector. Prof Keith Engel, CEO of the South Africans Institute of Taxation weighs in.

9 min video |

Could we still see a hike in VAT when the budget is tabled?

South Africans may still face an increase in VAT when the revised budget is tabled in March unless the government’s proposed spending plans are revised.

Tax experts share their views at the SAIT post-budget event.

6 min read |

Different types of taxes that we pay

In a conversation with Professor Keith Engel, CEO at the South African Institute of Taxation about the different types of taxes that we pay following the postponement of a budget speech due to the disagreements about the two-percentage point increase in VAT.

24 minute audio

Could we still see a hike in VAT when the budget is tabled?

South Africans may still face an increase in VAT when the revised Budget is tabled in March unless the government’s proposed spending plans are revised. Panelists at the SAIT post-budget event discuss.

5 minute read

Budget speech postponed to March – Keith Engel

The Democratic Alliance said the postponement of the national budget speech is the victory for the people of South Africa as it prevents the implementation of a 2% VAT increase that could severely impacted the country’s economy. To explore this issue joint by South African Institute of Taxation, CEO, Prof. Keith Engel.

1 min 52 second video

2025 Budget Speech has been postponed

The much-awaited 2025 Budget Speech has been postponed. This comes as there have been disagreements within the Government of National Unity over the budget. The Finance Minister Enoch Godongwana has announced that the amended Budget will be announced on March 12. Interview with the North West University Business School Economist Professor Raymond Parsons and The South African Institute of Taxation CEO Professor Keith Engel, on the implications of the Budget Speech being postponed.

18 minute 32 second video

SA Institute of Taxation on budget speech postponement

Discussion about the proposed increase in VAT which derailed the budget speech. The DA had warned it would not vote for such a budget in Parliament. The SA Institute of Taxation CEO Keith Engel comments.

10 minute 8 seconds video

Keith Engel rejects possibility of tax increase

The South African Taxation Institute CEO, Keith Engel has rejected the possibility of a vat increase and his comments comes ahead of Finance Minister’s first budget speech set to be delivered in Cape Town this afternoon, it’s the first under the Government of National Unity.

2 minute 15 seconds watch

Expectations on tax changes

With the 2025 National Budget Speech just a day away, critical tax and economic policy changes will soon be unveiled. Experts believe finance minister Enoch Godongwana will announce a raft of tax adjustments including VAT, personal income tax and corporate tax, to cover the revenue shortfall.

2 minutes and 57 video

SAIT CEO, Keith Engel Shares 2025 Budget Expectations

In an interview on On Point with Liabo Setho, SAIT CEO Keith Engel discussed anticipated tax policy changes ahead of the 2025 National Budget Speech.

6 min read | 7 min video

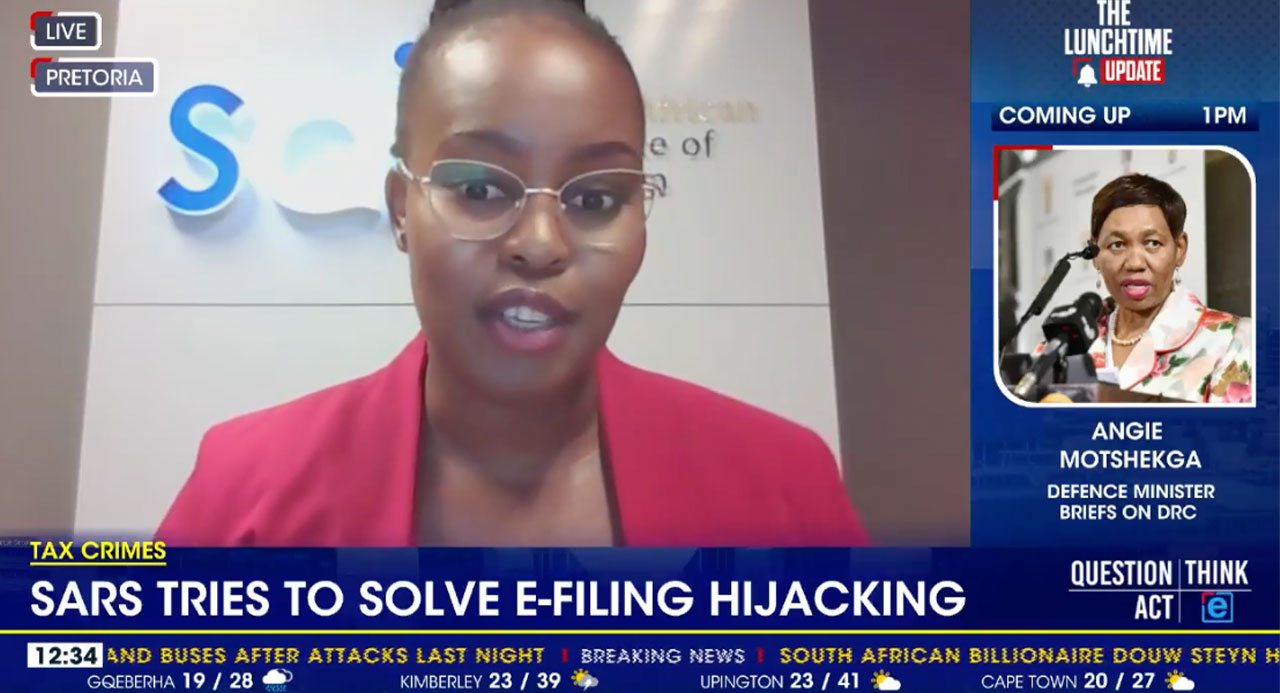

Protecting Taxpayers: SAIT’s Role in Tackling eFiling Profile Hijacking

In a recent Ilungelo Lako interview on SABC Live, Keitumetse Sesana, SAIT’s Strategic Lead for Stakeholder Engagement and Legislation, joined the Tax Ombud to discuss the rise in digital tax fraud.

1 min read | 2 min 26 sec video

Jeremy’s weekly wrap: Trump’s SA rift, wage hikes and tax forecasts

And then, with Budget 2025 just around the corner, Keith Engel, CEO of the South African Institute of Taxation, joined us to discuss key tax developments.

5 minute read

Understanding the Tax Ombud’s eFiling Security Survey: Insights from SAIT

Keitumetse Sesana joined eNCA’s Uveka Rangappa to discuss the increasing threat of eFiling profile hijacking and how taxpayers can protect themselves.

1 min read | 2 min 26 sec video

Key tax changes in 2025

Understanding if there will be key tax changes in 2025 with Keith Engel, CEO of the South African Institute of Taxation.

5 minute read

SA’s 2025 tax landscape: Risks, compliance and key changes

‘I think the biggest one that people are worried about is the NHI, which would then say goodbye to the medical credits. It’s only a matter of time before medical credits go,’ says Keith Engel, CEO of the South African Institute of Taxation.

7 minute 37 second podcast

SA’s 2025 tax landscape: risks, compliance and key changes

SAIT CEO, Keith Engel, recently sat with Jeremy Maggs of @Moneyweb for an interview discussing SA’s 2025 tax landscape: risks, compliance and key changes.

‘US funding to SA minimal’ – SA government

What impact will a loss of US funding really have on SA? How SA’s labour law can help the Just Energy Transition process and what happens when the pilot can’t fly the plane? SAIT CEO Professor Keith Engel engages with Jeremy Maggs and other guests to deliberate on the matter.

30 minute podcast

Excise taxes on beer – balancing revenue and health

Excise taxes on beer have become a contentious issue, raising concerns about their impact on consumers, producers and the economy. Professor Keith Engel of SAIT shares his views.

5 minute read

Tabling of new fiscal framework

Chief Economist at Econometrix, Dr Azar Jammine and Prof Keith Engel, CEO of the South African Institute of Taxation talk about the implications of the National treasury having to table the new fiscal framework.

8 min 49 second video

SARS gives window for VAT increase reversals

Sars gives window for VAT increase reversals BACKTRACKING

5 min read

Now you see it, now you don’t

In mid-April it was still all systems go for the VAT rate to increase to 15.5% on 1 May 2025. A week later, South African businesses and consumers woke up to the news that Finance Minister Enoch Godongwana had withdrawn the proposed increase of 0.5 percentage points.

3 min read

SARS gives businesses more time for VAT increase reversals

The South African Revenue Service (Sars) has given businesses and service providers that cannot immediately reverse the 15.5% VAT charge an opportunity to do so by May 15.

3 min read

For Press Inquiries

As Featured In: